So the MACD zero lag with the 50 E MA filter, was not that better than the MACD zero lag with 200 E MA filter.

That’s because, some of the trades that were lost last time, were filtered by the 50 E MA, but it also filtered some of the winning trades. If you look at the profit graph, you will notice that it still looks very similar to the previous one. But why? MACD zero Lag gives false signals when the pullback is big, but we are filtering the longer pullbacks with 50 E MA right? Well yes, but now we have another problem. And if you look closely, the profit graph with the 50 moving average is also starting to go down. Because last time, the profit graph in the Trading Rush App, went down soon after making this upward move. Now one might think that the 50 E MA is better, but hold that thought. But when the trend got weaker, some of the trades that were lost last time, were filtered by the 50 period moving average. That’s because the trades that were won last time, made a profit this time as well. Just like last time, the profit graph at the start, went in the upward direction. To find out if it actually works in the long run, and to find out if a different moving average can magically turn one of the worst trading strategies into a profitable one, I took 100 trades with it, and here’s what I found out. This doesn’t mean the MACD zero lag strategy will magically become profitable with the 50 E MA. If we plot both 50 and 200 E MA on the same chart, and insert the Zero Lag MACD indicator that lost money in the last video, you can see, that the False signals that were valid with the 200 period moving average, were filtered with the 50 period moving average.

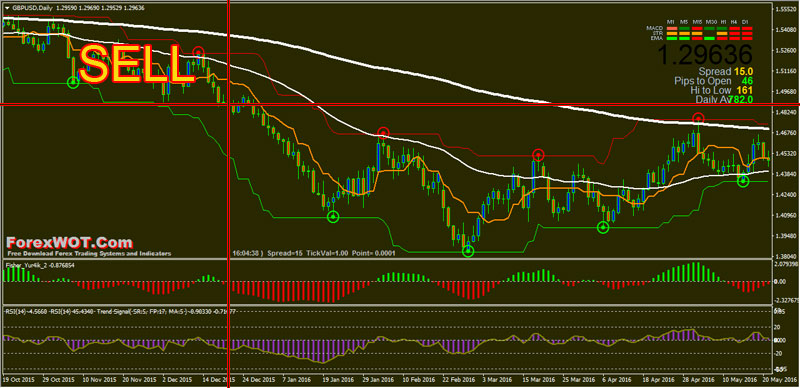

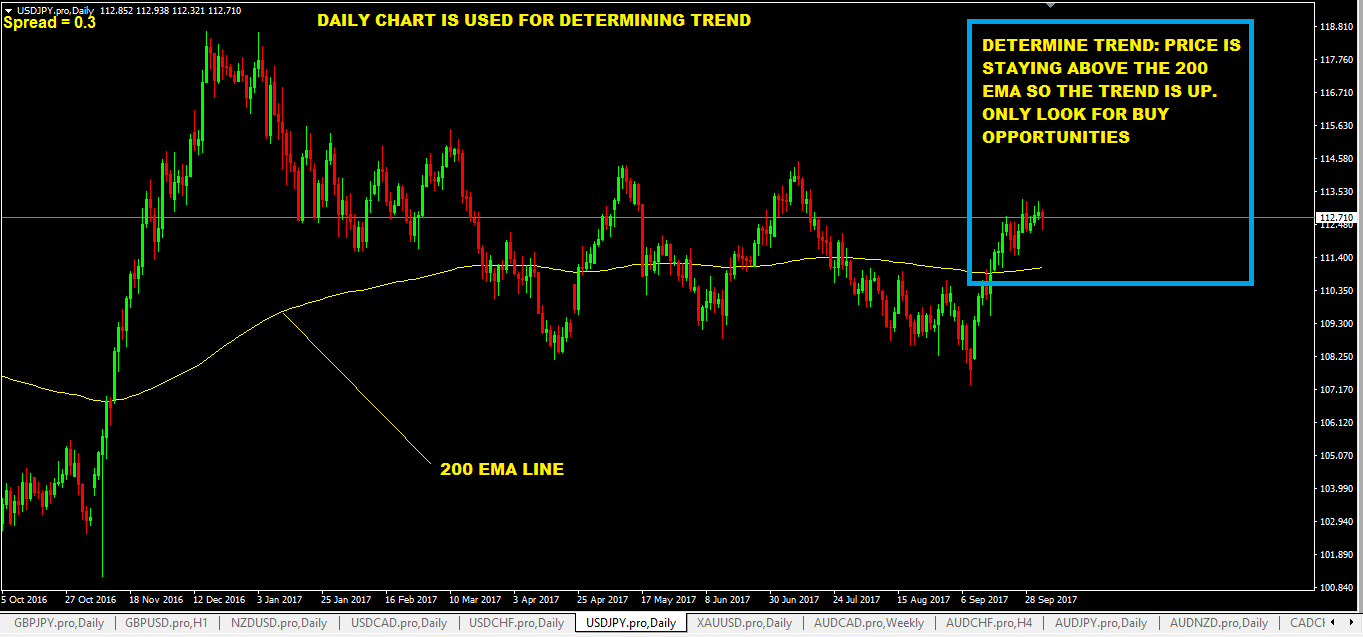

As you can see, the 200 E MA was acting as a support, and price made a move up and the profit target was hit. For example, here’s a trade analysis I shared on Patreon. Moving averages, especially the 200 period moving average, also works as a good support and resistance in a trend. And when the price is trending strongly in one direction, you can use the moving averages to find the average price, instead of buying and selling at the extreme top and extreme bottom. So when the price is in a range, you can use the moving average to filter bad trades setups. In simple words, moving averages are nothing but averages of the previous candles.

Since I have already explained what a Zero Lag MACD is, and the strategy based around it in the last video, lets focus on the 200 and 50 period moving averages this time. So if we use a smaller period E MA instead of 200 moving average, the false signals should be filtered right? Well, why don’t we test the same strategy with the 50 period exponential moving average, to see if the bad strategy can become good because of a different moving average? When the pullback was big, it was giving multiple false signals in a row. But what if the strategy got such a low win rate, because of the 200 Exponential moving average, and using a 20 or 50 E MA can increase the winrate? The Faster MACD indicator we saw in the last video, was really bad at showing the end of the pullback in a trend. In fact, it was one of the worst trading strategies we have tested on the Trading Rush channel. MACD Trading Strategy tested 100 times : Ĭan the 20 period moving average increase the winrate of this trading strategy? Last time I tested the MACD zero lag trading strategy 100 times with a 200 moving average, and it didn’t have a good winrate. Support the Channel on Patreon (Thanks): Moving Average Trading Strategy to increase the win rate in Forex and Stock Market Trading… I took 100 but actually 200 trades with EMAĭownload Official Trading Rush APP (Thanks): Interesting complete video top searched Personal Trading Style, 80% Successful Trading System, and Zero Lag MACD Crossover, 50 EMA vs 200 EMA? I took 100 TRADES to find the TRUTH… Trading Strategy – Forex Day Trading.

0 kommentar(er)

0 kommentar(er)